ad valorem tax florida ballot

40 percent of the assessed value of all other. A Manatee County Economic Development Ad Valorem Tax Exemptions Referendum ballot question was narrowly approved on the June 18 2013 election ballot in Manatee County which is in Florida.

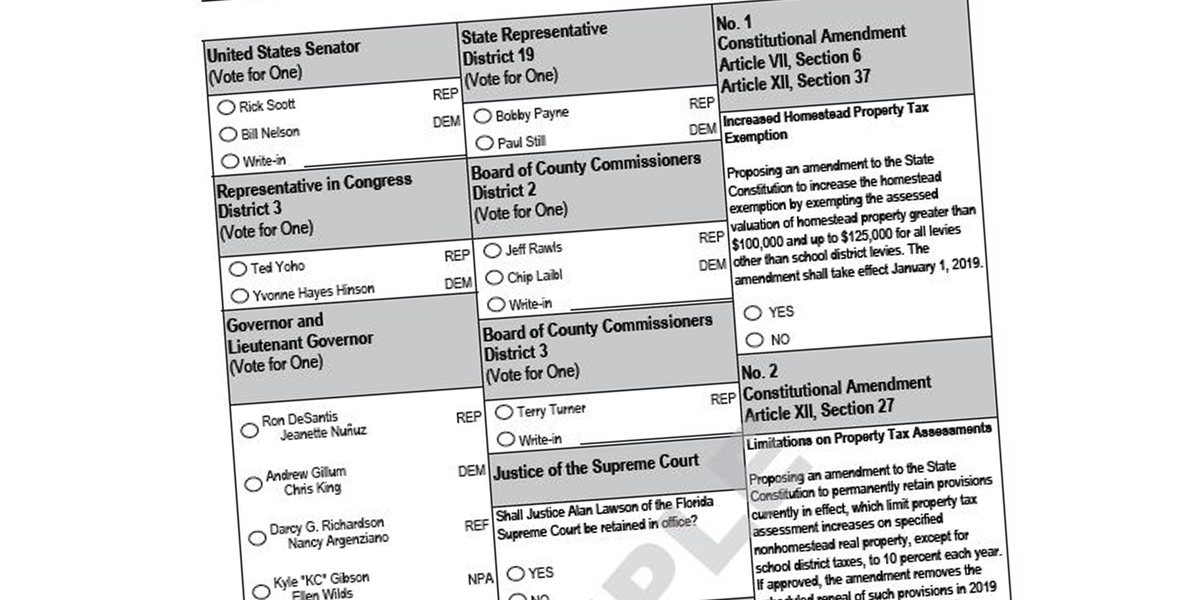

Voter S Guide For Florida S 6 Proposed Constitutional Amendments

Ad Get Access to the Largest Online Library of Legal Forms for Any State.

. An ad valorem tax which is Latin for according to value is any tax imposed on the basis of the monetary value of the taxed item Sales tax Main article. Ad valorem is Latin for according to value and this kind of tax. The Real Estate and Tangible Personal Property tax rolls are prepared by the Property Appraisers office.

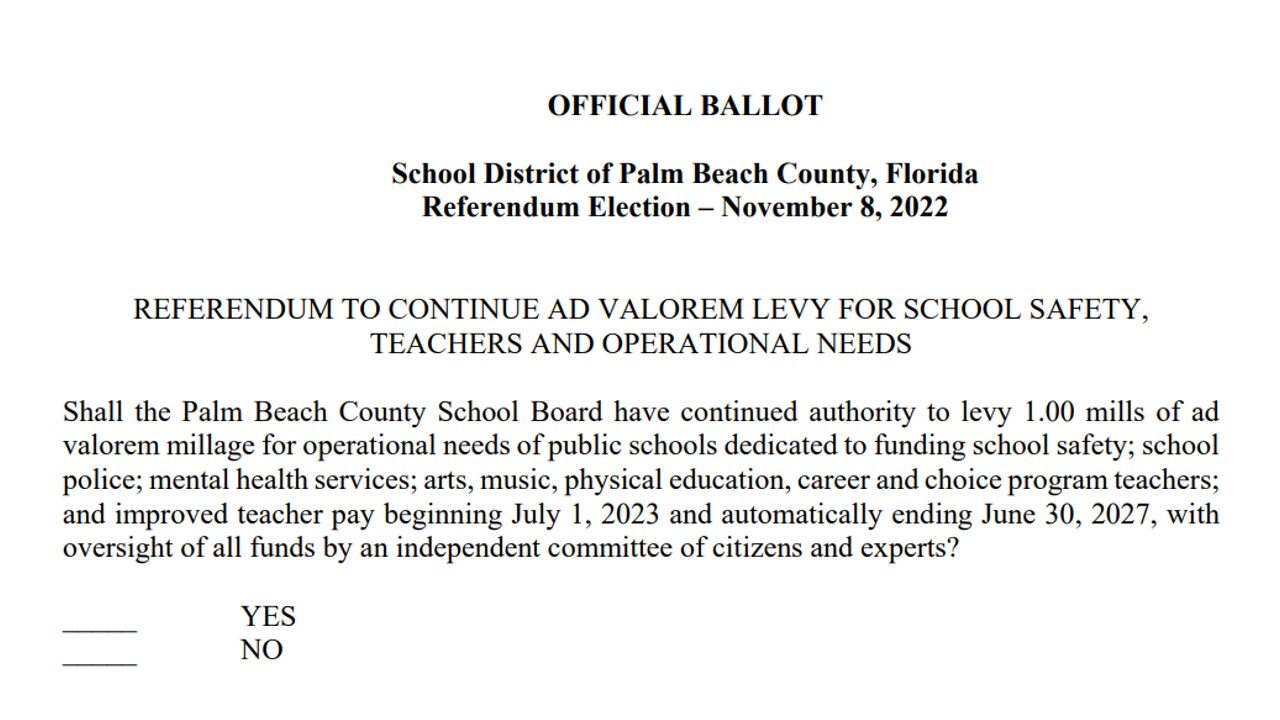

30 percent of the assessed value of any homestead property eligible for additional exemption for certain seniors. 2 2010 General Outcome. The district school board pursuant to resolution adopted at a regular meeting shall direct the county commissioners to call an election at which the electors within the school districts may approve an ad valorem tax millage as.

To prohibit ad valorem taxes on real estate and tangible personal property and repeal provisions relating to such taxation to conform. The measure authorized the Board of County Commissioners to grant property tax exemptions to businesses that are developing and creating new full-time jobs in the county. Often called property taxes Non-ad valorem Assessments.

The most common ad valorem taxes are. It is most often collected by the seller of the good or service and then transferred to. Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes.

Florida Ballot Measure - Constitutional Amendment 2. Provides for state assumption of. Aug 21 2020 0428 PM CDT.

Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo. They determine the ownership mailing address legal description and value of the property. 11 Personal property for the purposes of ad valorem taxation shall be divided into four categories as follows.

Ad valorem ie according to value taxes are. View Full Text pdf Provides that the homestead property tax discount for certain veterans with permanent combat-related disabilities carries over. If enacted this measure would have mandated that no county or municipality shall levy ad valorem taxes on more than 30 percent of the value of any homestead property for certain seniors 40 percent of the value of all other.

The tax roll describes each non-ad valorem assessment included on the property tax notice bill. Copies of the non-ad valorem tax roll and summary report are due December 15. Non-ad valorem assessments are.

101173 District millage elections. The 2021 Florida Statutes. To authorize the Legislature to provide for any other form of taxation to replace revenues foregone as a result of the repeal of real estate and tangible personal property taxes.

Uniform throughout the jurisdiction. Exemptions for Homestead Disability Widows and Agricultural Classifications are also determined by the Property Appraisers office. 10 Mill means one onethousandth of a - United States dollar.

Proposing an amendment to the state constitution to authorize the legislature by general law to exempt from ad valorem taxation the assessed value of solar or renewable energy source devices subject to tangible personal property tax and to authorize the legislature by This is the last of six on this years ballot and its full name is. On the tax roll. The Florida Revenue Estimating Conference met Tuesday morning to review trends in ad valorem tax receipts.

The measure authorized the Board of County Commissioners to grant property tax exemptions to businesses that are developing and creating new full-time jobs in the county. Sales tax Main article. The sovereign right of local governments to raise public money.

Examples of values that could be used to determine an ad valorem tax include the price of a product for a sales tax or the assessed value of a home for a property tax. WMBB Bay County voters will have the chance to vote in November yet again on whether to renew ad valorem tax exemptions for businesses. Sales tax is applied to goods and services at the point of purchase.

More than 93 of the tax increase are. Final numbers were expected later in CONTINUE READING. A Manatee County Economic Development Ad Valorem Tax Exemptions Referendum ballot question was narrowly approved on the June 18 2013 election ballot in Manatee County which is in Florida.

Ad Valorem Tax Discount for Spouses of Certain Deceased Veterans Who Had Permanent Combat-Related Disabilities. Ad Valorem Tax Discount for Spouses of Certain Deceased Veterans. The Property Tax Oversight PTO program publishes the Florida Ad Valorem Valuation and Tax Data Book twice a year.

This is the last of six on this years ballot and its full name is. Sales tax Sales tax is one of the primary taxes levied by state governments. Sales tax Sales tax is one of the primary taxes levied by state governments.

Body authorized by law to impose ad valorem taxes. Housing and Property Military Personnel Constitution Taxes. An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendmentIf enacted this measure would have mandated that no county or municipality shall levy ad valorem taxes on more than 30 percent of the value of any homestead property for certain seniors 40 percent of the value of all other.

CONSTITUTIONAL AMENDMENT ARTICLE VII SECTION 3 ARTICLE XII SECTION 31 HOMESTEAD AD VALOREM TAX CREDIT FOR DEPLOYED MILITARY PERSONNEL. 1 MILLAGE AUTHORIZED NOT TO EXCEED 2 YEARS. An ad valorem tax which is Latin for according to value is any tax imposed on the basis of the monetary value of the taxed item.

Article VII Section 6 and Article XII. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Millage may apply to a single levy of taxes or to the cumulative of all levies.

A lien against property. The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive summary of reported state- county- and municipal-level information regarding property value millages and taxes levied. The measure would have limited the power of local government to raise revenue from the ad valorem taxes - no county or municipality would have been allowed to levy ad valorem taxes on more than.

An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendment. It is most often collected by the seller of the good or service and then transferred to. Ad valorem taxes are taxes that are levied as a percentage of the assessed value of a piece of property.

Sales tax is applied to goods and services at the point of purchase. Based on the assessed value of property.

A Guide To The Constitutional Amendments On Florida S 2018 Ballot Wusf Public Media

Six Florida Constitutional Amendments Appear On This Year S Ballot 2020 Amendments Chronicleonline Com

What Are These Florida Amendments All About Nonpartisan Analysis From The League Of Women Voters Palm Coast Observer

Duval School Board Votes 6 1 To Put Property Tax Onto August Ballot Wjct News

Amendments 5 And 6 On Florida S Ballot Focus On Florida Property Taxes The Independent Florida Alligator

Florida S Latest Fair Elections Imbroglio Concerns Party Names On The Ballot The Fulcrum

Understanding Your Vote Naples Florida Weekly

2020 Florida Constitutional Amendments Ballot League Of Women Voters Of Orange County

Palm Beach County Schools Want To Continue Getting Your Tax Money

What Are These Florida Amendments All About Nonpartisan Analysis From The League Of Women Voters Palm Coast Observer